capital-study.ru

Categories

I Have Terrible Credit And Need A Loan

If you're in need of fast cash but have a less That doesn't mean it's impossible to get a personal loan with a fair or poor credit score. What can I use my loan for when I have poor credit? Loans for bad credit give people with low credit scores the financial lifeline they may urgently need. Borrowers with credit scores below can still qualify for bad-credit loans from reputable lenders like Upstart and Upgrade. Need a loan, but have low or bad credit? You can still get a loan. People's Community Federal Credit Uniontells you how. Learn more! Knowing what you need for approval and then comparing lenders is the best way to get a bad credit personal loan if you have a low credit score. Everyone can have a low cash moment. We're here to help when you do How long will it take to get the money I need? After you apply, you'll get a. Get the money you need. Whether you have good credit, bad credit or Running low on cash, but payday is still days away? Early Check Advance. How To Qualify for a Bad Credit Loan. Assess Your Credit Scores. A poor credit history or low credit score may not disqualify you for a personal loan online. Also, owing only small amounts of money—or having low usage numbers—will help maximize your score. Again, having bad credit won't necessarily disqualify you. If you're in need of fast cash but have a less That doesn't mean it's impossible to get a personal loan with a fair or poor credit score. What can I use my loan for when I have poor credit? Loans for bad credit give people with low credit scores the financial lifeline they may urgently need. Borrowers with credit scores below can still qualify for bad-credit loans from reputable lenders like Upstart and Upgrade. Need a loan, but have low or bad credit? You can still get a loan. People's Community Federal Credit Uniontells you how. Learn more! Knowing what you need for approval and then comparing lenders is the best way to get a bad credit personal loan if you have a low credit score. Everyone can have a low cash moment. We're here to help when you do How long will it take to get the money I need? After you apply, you'll get a. Get the money you need. Whether you have good credit, bad credit or Running low on cash, but payday is still days away? Early Check Advance. How To Qualify for a Bad Credit Loan. Assess Your Credit Scores. A poor credit history or low credit score may not disqualify you for a personal loan online. Also, owing only small amounts of money—or having low usage numbers—will help maximize your score. Again, having bad credit won't necessarily disqualify you.

If you're getting back on your feet financially, work with an expert loan consultant to explore options to help for loans with bad credit. Some lenders that cater to borrowers with poor credit have low loan maximums, but Upgrade allows borrowers to apply for as much as $50, And it requires a. bad credit or a poor credit history. A no-FICO-credit-check loan may seem like a good fast-cash option, but there are always risks -- particularly if you. Poor ( - ). The term “bad credit” usually refers to a FICO score of - A low FICO score is a common reason why traditional lenders. Loans for people with bad credit scores · Secured loans · Auto loans · Joint loans · Credit card cash advance · Home equity loans · Home equity line of credit (HELOC). What are bad credit loans? Lenders often have minimum credit scores to qualify, which can make it harder for borrowers with poor credit to access most loans. A credit score between is considered bad or poor. A poor credit score matters for a lot of reasons. If you want to get a loan, credit card, or mortgage. Cons. Loan amounts only up to $40,; Low mobile app rating from Android users; All loans get an origination fee of % - %. What to know. +. LendingClub. A bad credit score doesn't have to prevent you from owning a home. Learn how to get a home loan with poor credit by following the tips in this quick guide. You can get a student loan without a co-signer if you have bad credit or no credit – most federal loans do not require a co-signer – but you may need one to get. Loans for Bad Credit. We understand a low credit score can make it difficult to get an affordable loan so we don't base our funding decisions exclusively on. loan with a fair interest rate – even if you have bad credit. If Borrow up to $40, at an interest rate as low as % APR (depending upon credit). The best home loan option for you if you have bad credit depends on how low your score is. If your score is below , you probably should look into an FHA loan. How Do I Get a No-Collateral Loan for Bad Credit? Most lenders try to take on as little risk as possible. A secured personal loan with added collateral gives. While it's still a greater risk to loan money to a bad credit It's fairly common for individuals to have a high income but a bad or poor credit score. To get a personal loan with bad credit, you should ideally have a reliable and sufficient income to make loan payments, as well as a low debt-to-income ratio . A low DTI ratio is a good indicator that you have enough income to meet your need more credit. You have options when it comes to paying for a large. CASH 1 will lend you $50 to $50, with one of our Personal Loans even if you have bad credit or a low credit score. When you need money fast, having bad. A low credit score should not limit you from getting a loan. Find the best loans for bad credit at the best rates for you. Having a low credit score tells lenders and other businesses Find out what else you can do if you have poor credit and need help improving your credit.

What Hurts Credit The Most

A few late payments are not an automatic "score-killer." An overall good credit history can outweigh one or two instances of late credit card payments. However. Hard inquiries will reduce your credit score anywhere from points for about a year. For most people, this won't have a negative impact on ability to borrow. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores. Many factors can affect the credit score created by each credit reference agency, but the way you manage existing financial accounts is a major influence. Your. Payment history — whether you pay on time or late — is the most important factor of your credit score making up a whopping 35% of your score. Your payment history typically has the most significant impact on credit scores. Carrying credit card balances or regularly missing payments may decrease. Hard inquiries such as actively applying for a new credit card or mortgage will affect your score. Read below to see how much hard inquiries can affect your. Anywhere up to 7% is very healthy utilization that shouldn't hurt your credit score by more than two or three points. Most of them had. For example, under some scoring systems loans to consolidate your debt — but not loans for buying a house or car — may hurt your credit score. Credit scoring. A few late payments are not an automatic "score-killer." An overall good credit history can outweigh one or two instances of late credit card payments. However. Hard inquiries will reduce your credit score anywhere from points for about a year. For most people, this won't have a negative impact on ability to borrow. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores. Many factors can affect the credit score created by each credit reference agency, but the way you manage existing financial accounts is a major influence. Your. Payment history — whether you pay on time or late — is the most important factor of your credit score making up a whopping 35% of your score. Your payment history typically has the most significant impact on credit scores. Carrying credit card balances or regularly missing payments may decrease. Hard inquiries such as actively applying for a new credit card or mortgage will affect your score. Read below to see how much hard inquiries can affect your. Anywhere up to 7% is very healthy utilization that shouldn't hurt your credit score by more than two or three points. Most of them had. For example, under some scoring systems loans to consolidate your debt — but not loans for buying a house or car — may hurt your credit score. Credit scoring.

Most FICO scores fall in a range of to , with higher scores indicating lower credit risk. Scores can be placed into one of these five categories. High balances can hurt your score. Lenders prefer that you use less than 30 percent of your available credit. You may be able to check what percent you're using. The five biggest factors that affect your credit score are payment history, amounts owed, length of credit history, new credit, and types of credit. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores. Several factors can hurt your credit score, including if you make several late payments or open to many credit card accounts at once. You can ruin your credit. If your credit score is in the highest category, , a lender might charge you percent interest for the loan.1 This means a monthly payment of $ The most important factors to your credit score · Payment history: 40% · Depth of credit/history: 21% · Credit utilization: 20% · Balances/amounts owed: 11% · Recent. financial life. Your credit scores (most people have more than one) can affect your ability to qualify for a loan or get a credit card by giving potential. Keep your balances low. You don't want to max out your credit cards. Utilization is the second-most impactful factor affecting your credit score, and carrying. credit report, which can negatively affect your credit score. When you Most credit card, auto loan companies and financial institutions where you. Generally, it's not a good idea to max out your credit card. If you do use up your entire credit limit on your card, you'll discover that your credit score may. Learn more about what factors make for good credit scores, how credit bureaus—Equifax®, Experian® and TransUnion®—and credit-scoring companies—FICO® and. What is a credit report? · your name, address, and Social Security number · your credit cards · your loans · how much money you owe · if you pay your bills on time. How much you owe compared with your credit limits – your credit utilization ratio – accounts for 30% of your FICO score. That means if you rack up a big balance. What is a personal credit report? Your personal credit report is a summary of information on file with a credit bureau, a company. In fact, owing the same amount but having fewer open accounts may lower your scores. Come up with a payment plan that puts most of your payment budget towards. In most cases, there is a charge for borrowing The FICO credit score ranges from to , with the lower scores representing higher credit risk. What If I Need a Loan or Credit Card Immediately After Bankruptcy? Luckily, most mortgage companies provide FHA loans for scores of Traditional. Occur when you apply for credit such as a loan, mortgage, or credit card. Hard inquiries may impact your credit scores. Soft Inquiries: Credit checks such as. Checking your own credit won't hurt your credit scores. When you check your For most people, buying a new home means taking on new expenses.

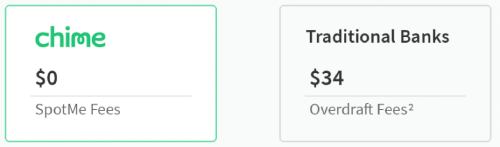

What Is Chime Overdraft Fee

SpotMe® for Credit Builder is an optional, no interest/no fee overdraft line of credit tied to the Secured Deposit Account. SpotMe on Debit is an optional, no. Overdraft fees will apply if you go beyond this limit. As time passes and Chime determines your account to be healthy through things like. Chime, the bank would let you overdraft to a amount. You would get gas but your checking account would have overdraft fees. I wouldn't try. SpotMe® for Credit Builder is an optional, no interest/no fee overdraft line of credit tied to the Secured Deposit Account. SpotMe on Debit is an optional, no. Your limit may change at any time, at Chime's discretion. Although there are no overdraft fees, there may be out-of-network or third party fees. It's called an overdraft fee, and it typically costs $35 per transaction², even if you only overdrew your account by a few cents. Overdraft fees can add up. No monthly fees. 60k+ ATMs. Build credit. Get fee-free overdraft up to $¹ Chime is a tech co, not a bank. Banking services provided by bank partners. Fee-Free Overdraft: Chime offers a feature called “SpotMe” which allows you to overdraw your account on debit card purchases up to a certain limit without. Chime has no minimum balance, monthly fees, or overdraft fees. We don't believe in hidden fees or profiting from our members' misfortune. SpotMe® for Credit Builder is an optional, no interest/no fee overdraft line of credit tied to the Secured Deposit Account. SpotMe on Debit is an optional, no. Overdraft fees will apply if you go beyond this limit. As time passes and Chime determines your account to be healthy through things like. Chime, the bank would let you overdraft to a amount. You would get gas but your checking account would have overdraft fees. I wouldn't try. SpotMe® for Credit Builder is an optional, no interest/no fee overdraft line of credit tied to the Secured Deposit Account. SpotMe on Debit is an optional, no. Your limit may change at any time, at Chime's discretion. Although there are no overdraft fees, there may be out-of-network or third party fees. It's called an overdraft fee, and it typically costs $35 per transaction², even if you only overdrew your account by a few cents. Overdraft fees can add up. No monthly fees. 60k+ ATMs. Build credit. Get fee-free overdraft up to $¹ Chime is a tech co, not a bank. Banking services provided by bank partners. Fee-Free Overdraft: Chime offers a feature called “SpotMe” which allows you to overdraw your account on debit card purchases up to a certain limit without. Chime has no minimum balance, monthly fees, or overdraft fees. We don't believe in hidden fees or profiting from our members' misfortune.

Chime does charge overdraft fees for ach. Are you sure it isn't a recurring debit card transaction?

Chime's SpotMe feature lets you make debit card purchases and cash withdrawals that overdraw your account with no overdraft fees. Limits start at $20 and can. Introducing Chime's SpotMe: Fee-free overdraft up to $* for eligible members. Get started today. Open and maintain a checking account with no minimum balance · Pay no monthly service, minimum balance or overdraft fees · Overdraft up to $ with no fees when. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. That's why Chime offers a checking account with no minimum balance fees and no monthly fees. No fees for overdrafts. Traditional banks charged $11 Billion in. Traditional typically charge fees ranging between $10 to $40 on overdrafts. Savings Account. Source: Chime. Chime offers a savings account with a 2% APY as of. Yes, you can overdraft with a chime card. Check out SpotMe, which is Chime's version of overdraft protection. They don't charge overdraft. There is no overdraft fee, though it is possible to overdraft but not over the spot me limit you're allowed. If you're not one that likes over drafting anyway. If I pay for gas at the pump, then fill my tank clearly it'll overdraft, if I don't have spotme, chime is supposed to decline the purchase. Chime offers a checking account with no minimum balance fees and no monthly fees. No fees for overdrafts. Yes, you can overdraft with a chime card. Check out SpotMe, which is Chime's version of overdraft protection. They don't charge overdraft. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card. Overdraft fees will apply if you go beyond this limit. As time passes and Chime determines your account to be healthy through things like. No monthly fees. 60k+ ATMs. Build credit. Get fee-free overdraft up to $¹ Chime is a tech co, not a bank. Banking services provided by bank partners. A free online spend account with modern banking perks like early direct deposit and unique overdraft services. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Chime doesn't require a minimum balance and has no monthly fees or overdraft fees. There are no fees for using direct deposit or depositing checks with the. There is no overdraft fee, though it is possible to overdraft but not over the spot me limit you're allowed. If you're not one that likes over drafting anyway. In fact, with Chime's SpotMe®4, you are covered on overdraft fees. For newer users, Chime will cover overdrafts up to $20, but certain account holders can. Chime does charge overdraft fees for ach. Are you sure it isn't a recurring debit card transaction?

Best Rates For Home Equity Loans

Average overall rate: % · year fixed home equity loan: % · year fixed home equity loan: %. Whether you need a closed-end home equity loan or a line of credit, Veridian has you covered. Save more with our great rates and low closing costs. Best for Home Equity Loan Rate Overall: TD Bank · Best for Highest Home Equity Borrowing Limit: Navy Federal Credit Union · Best for Loan Amounts: BMO · Best for. Home equity loans tend to have considerably lower interest rates than credit cards or personal loans, which are generally not secured. The equity in your home can be used to help you fund your next big purchase. Compare home equity loan and line of credit rates from KeyBank to see what is. Introductory rate of % APR on New Home Equity Lines of Credit for 6 months then as low as % variable APR. 1; Allows you to borrow funds using the equity. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. Best Home Equity Loan Rates ; Navy Federal, %, $10, ; Discover, %, $35, ; Citi Bank, % – %, $25, ; BBVA Compass, % – %, $10, Some of our top picks for the best home equity loan rates are from Discover (%), Navy Federal Credit Union (%), Bethpage Federal Credit Union (%). Average overall rate: % · year fixed home equity loan: % · year fixed home equity loan: %. Whether you need a closed-end home equity loan or a line of credit, Veridian has you covered. Save more with our great rates and low closing costs. Best for Home Equity Loan Rate Overall: TD Bank · Best for Highest Home Equity Borrowing Limit: Navy Federal Credit Union · Best for Loan Amounts: BMO · Best for. Home equity loans tend to have considerably lower interest rates than credit cards or personal loans, which are generally not secured. The equity in your home can be used to help you fund your next big purchase. Compare home equity loan and line of credit rates from KeyBank to see what is. Introductory rate of % APR on New Home Equity Lines of Credit for 6 months then as low as % variable APR. 1; Allows you to borrow funds using the equity. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. Best Home Equity Loan Rates ; Navy Federal, %, $10, ; Discover, %, $35, ; Citi Bank, % – %, $25, ; BBVA Compass, % – %, $10, Some of our top picks for the best home equity loan rates are from Discover (%), Navy Federal Credit Union (%), Bethpage Federal Credit Union (%).

Check today's home equity loan rates ; Up to 80% LTV, % ; % - % LTV, % ; % - % LTV, % ; % - % LTV, %. If you want access to funds while paying interest only on what you spend — like a credit card, but with better rates — a HELOC could be a good choice. Ask a. If you have property in Texas, a home equity loan or home equity line of credit (HELOC) can be an economical way to obtain a low-rate loan. Home Equity Loan 20 Year: For example, the payment on a $70,, year fixed-rate loan at % (% APR) with an LTV of 80% is $ Points due at. What are current home equity interest rates? ; Home equity loan, %, % - % ; year fixed home equity loan, %, % - % ; year fixed home. USC Credit Union offers competitive rates on home equity loans and HELOCs for home renovations, debt consolidation and vacations. Find the best HELOC rates. % APR FOR 6 MONTHS ON A HOME EQUITY LINE OF CREDIT*. turn your equity into upgrades with this incredible rate! You can also use your Home equity line of. Most home equity loan rates are indexed to a base rate called the prime rate, which is tied to the federal funds rate set by the Federal Reserve. The prime rate. Home Equity Plus ; % · 5 years, $, up to 80%. The target range for the federal funds rate remains high, clocking in at % to %. Learn more: Compare current mortgage interest rates. The Fed has. Current Home Equity Loan Rates ; $25, % ; $50, % ; $, % ; $, %. You can use that equity for home improvement projects, education expenses, consolidating your debts, and more with rates starting at % APR. *** year adjustable-rate home-equity loan rates range from % APR to % APR. The APR is variable, based on an index and margin. On a loan of. Best home equity loan rates · Old National Bank: Best for fast closing times. · TD Bank: Best for variety of loan terms. · BMO Harris: Best for rate discount. Home Equity Rates ; 5 Year Fixed Home Equity Loan · % ; 10 Year Fixed Home Equity Loan · % ; 15 Year Fixed Home Equity Loan · % ; 20 Year Fixed Home. Homeowners can get access to a large sum of cash at a fixed rate by borrowing against their property's value with a home equity loan. HELOC during this time. Home Equity Loan. When you need funds all at once for a big expense at a fixed rate. A home equity loan is best when you have one. Home Equity Rates ; 84 Months, % ; Months, % ; Months, % ; Months, %. Rates are as low as % APR and are based on an evaluation of credit history, CLTV (combined loan-to-value) ratio, loan amount, and occupancy, so your rate. Get low rates & fast approval decisions on your SCCU home equity line of credit. Low initial draw requirements let you access your HELOC funds when you need.

Can Cash App Deposit Checks

Set up Direct Deposits and start receiving your paychecks with Cash App. You can receive up to $25, per direct deposit, and up to $50, in a hour period. What types of checks can I use for mobile deposits? You can deposit personal, business, and most government checks. All checks must be payable in U.S. Deposit paychecks, tax returns, and more to your Cash App balance using your account and routing number. You can receive up to $25, per direct deposit. Click&Capture Deposit®. Just take a picture of your check, and have it deposited into your account. Send Money Zelle. Send. Mobile Check Deposit · From the Account Summary screen, select Move Money, then Deposit Checks. · Select Deposit To and choose the account. · Enter the deposit. Make cash or check deposits by ATM, in-person or by using the Capital One online mobile app. How Do You Deposit a Check Using Cash App? · Open up the Cash App. Tap the green box icon that has a white dollar sign inside. Make sure that you're signed into. Note: Checks will need to be deposited within days of the check issue date otherwise they will be declined. Some checks might have a shorter deposit. Select Cash App users can deposit a paper check using the Mobile Check Capture feature. If the feature is available to you, you can deposit your check in just. Set up Direct Deposits and start receiving your paychecks with Cash App. You can receive up to $25, per direct deposit, and up to $50, in a hour period. What types of checks can I use for mobile deposits? You can deposit personal, business, and most government checks. All checks must be payable in U.S. Deposit paychecks, tax returns, and more to your Cash App balance using your account and routing number. You can receive up to $25, per direct deposit. Click&Capture Deposit®. Just take a picture of your check, and have it deposited into your account. Send Money Zelle. Send. Mobile Check Deposit · From the Account Summary screen, select Move Money, then Deposit Checks. · Select Deposit To and choose the account. · Enter the deposit. Make cash or check deposits by ATM, in-person or by using the Capital One online mobile app. How Do You Deposit a Check Using Cash App? · Open up the Cash App. Tap the green box icon that has a white dollar sign inside. Make sure that you're signed into. Note: Checks will need to be deposited within days of the check issue date otherwise they will be declined. Some checks might have a shorter deposit. Select Cash App users can deposit a paper check using the Mobile Check Capture feature. If the feature is available to you, you can deposit your check in just.

PayPal's Cash a Check feature lets users deposit checks on their mobile device and receive credit to their PayPal Balance account in minutes, with fees. How do I make a deposit by cashing a check at a financial service center (location offering check cashing, payday loans, money transfers)? · How fast will my. We love to see you in the branch, but we're happy to save you a trip. Using your compatible Apple or Android device, you can deposit checks remotely—wherever. With mobile check deposit, you can deposit checks and access funds securely using the Regions Mobile App. Enjoy the convenience of mobile deposit today. You can deposit a check directly through the Cash App — and the better news is that it's more convenient than going to a bank once you know how to do it. Depositing by Mobile App. Department depositors can use the J.P. Morgan (JPM) Access mobile deposits application for check deposits (including money orders). With Mobile Deposits, you can deposit personal and business checks safely and securely with your mobile device—all without having to visit a branch or ATM. Take a picture of the front of the check. Then flip it over, make sure you've signed the back, and take a picture. Enter the amount you're depositing. Add a. How can I access mobile check deposit? · Endorse (sign) the back of the check · Open the One app · Open Cash Control · Choose Deposit Check · Enter the amount of the. The check deposit feature in Cash App allows users to deposit physical checks directly into their Cash App balance using their smartphone's. I'm never seen an insurance company claim check being deposited through cash app. Insurance companies cut paper checks so that gives them a. Note: Checks will need to be deposited within days of the check issue date otherwise they will be declined. Some checks might have a shorter deposit. With the Ingo® Money App, cash paychecks, business checks, personal checks—almost any type of check—anytime, anywhere. Get your money in minutes. You can deposit paper money into your Cash App balance at participating retailers. Cash App charges a flat-rate $1 processing fee on each paper money deposit. Q: What is Mobile Deposit and how do I use it? A: Mobile Deposit is a feature within Digital Banking that allows you to deposit checks by using your phone's. Mobile check deposit · Examples of acceptable checks · When the money will be available · Deposit limits · Deposit at an ATM. The banker will provide a receipt for the transaction. Do personal checks expire? While personal checks do not technically expire, banks have the option to. Cash App offers standard transfers to your bank account and Instant transfers to your linked debit card. Standard transfers are free and arrive within Cash checks on a mobile device anytime, anywhere. Get your money in minutes in your bank, PayPal, and prepaid card accounts. Back: Do the same for the back of the check. Ensure the check is endorsed (signed on the back) AND you wrote or selected "for mobile deposit only" under your.

Pancake Crypto

Earn crypto by learning about blockchain · Blog. Expand your knowledge and get pancake-swap-lottery. Cryptocurrency prices are subject to high market. Swapping crypto with PancakeSwap and your Ledger device · Plug your Ledger device into your computer and open the Binance Smart Chain app on your device. · Open. Discussion topics must be related to Crypto/NFTs/DeFi and PancakeSwap. Behave with civility and politeness. Do not use offensive, racist or homophobic language. Coins and tokens can be modified so they can be exchanged on a non-native blockchain, a process called wrapping. On PancakeSwap, cryptocurrency from another. Recently launched projects on PancakeSwap platform To launch a project on a launchpad crypto platform means to create and deploy a blockchain-based. CAKE is the crypto asset of the PancakeSwap decentralized exchange (DEX) and ecosystem. PancakeSwap is a DEX built on BNB Smart Chain (BSC) that facilitates. CAKE is the native cryptocurrency of PancakeSwap, the largest decentralized exchange for BEP20 tokens, which are digital assets that are compatible with the. PancakeSwap - Logo. PancakeSwap · DataLearnFinancial statement Crypto screener. PancakeSwap - Logo. PancakeSwap(CAKE). Exchanges (DEX). The price of Pancake Swap is $ You can watch CAKE and buy and sell other cryptocurrencies, stock and options commission-free on Robinhood. Earn crypto by learning about blockchain · Blog. Expand your knowledge and get pancake-swap-lottery. Cryptocurrency prices are subject to high market. Swapping crypto with PancakeSwap and your Ledger device · Plug your Ledger device into your computer and open the Binance Smart Chain app on your device. · Open. Discussion topics must be related to Crypto/NFTs/DeFi and PancakeSwap. Behave with civility and politeness. Do not use offensive, racist or homophobic language. Coins and tokens can be modified so they can be exchanged on a non-native blockchain, a process called wrapping. On PancakeSwap, cryptocurrency from another. Recently launched projects on PancakeSwap platform To launch a project on a launchpad crypto platform means to create and deploy a blockchain-based. CAKE is the crypto asset of the PancakeSwap decentralized exchange (DEX) and ecosystem. PancakeSwap is a DEX built on BNB Smart Chain (BSC) that facilitates. CAKE is the native cryptocurrency of PancakeSwap, the largest decentralized exchange for BEP20 tokens, which are digital assets that are compatible with the. PancakeSwap - Logo. PancakeSwap · DataLearnFinancial statement Crypto screener. PancakeSwap - Logo. PancakeSwap(CAKE). Exchanges (DEX). The price of Pancake Swap is $ You can watch CAKE and buy and sell other cryptocurrencies, stock and options commission-free on Robinhood.

Crypto Energy Drink is a brand new energy drink that is very different than what is currently on the market! Not only does the drink TASTE AMAZING but each. How is cryptocurrency taxed? In the United States, cryptocurrency is subject to ordinary income and capital gains tax. IRS tracking crypto gains and income. How to use PancakeSwap DEX. All you need is a credit card to buy, sell, and swap crypto at this decentralized cryptocurrency exchange. How to use. Bunny - DeFi yield farming aggregator and optimizer for Binance Smart Chan (BSC) and Ethereum (ETH). @PancakeSwap. ·. 2h. Let's welcome $ORDER . @OrderlyNetwork.) to Ethereum PancakeSwap! Stake ORDER-ETH (% fee tier) V3 LP, Earn CAKE: https://. Pancake Swap Clone Script is an instant solution to launch a platform similar to the Pancake crypto exchange that is capable of operating on the Binance Smart. crypto. PancakeSwap has a BEP token, CAKE, the main function of which is to incentivize liquidity provision to the PancakeSwap platform. What are CAKE's. supply of 1,, BUNNY coins. If you would like to know where to buy Pancake Bunny at the current rate, the top cryptocurrency exchanges for trading in. PancakeSwap, with its native cryptocurrency, CAKE, is one of the fastest-growing DeFi projects. Today, we discuss the market sentiments concerning this new. PancakeSwap CAKE tokens. There are many crypto wallets and services that support PancakeSwap, but in this guide we will be using Binance as it is easy to. PancakeSwap & Other Cryptocurrencies. Bitcoinbtc. $61, +%. Bitcoin Chart · Ethereumeth. $2, +%. Ethereum Chart · Tether. PancakeSwap is a decentralized exchange and yield farming platform that offers users a wide range of cryptocurrency trading and farming opportunities. About CAKE ; Category. Decentralized exchange ; Contract. Ethereum0x 4c ; Website. capital-study.rue ; Explorers. capital-study.ru ; Whitepaper. docs. Looking for a PancakeSwap Wallet to buy and store your PancakeSwap? Join 6+ million customers who trust Ledger hardware wallets to securely store their crypto. Why buy PancakeSwap on Changelly? Limits Beyond Your Dreams. Buy cryptocurrency with investments starting as low as $5. PancakeSwap · Logo of CAKE. Crypto Prices · PancakeSwapCAKE · $ · Pancakeswap is PancakeSwap Deploys on Ethereum Scaling Network Arbitrum in Expansion. Moving away from conventional cryptocurrencies, PancakeSwap operates on a decentralized exchange automated market maker (AMM). Being linked to Ethereum enabled. Want to buy crypto but don't know where to buy PancakeSwap? No worries! Binance offers many options where you can easily buy several cryptocurrencies. PancakeSwap is a DEX based on the Binance (BNB) blockchain, but it can work with coins and tokens from other chains, such as Ethereum (ETH). The CAKE token. What sets PancakeSwap apart from the likes of Uniswap and SushiSwap is that it runs on Binance Smart Chain (BSC) instead of Ethereum. Because of that, it is.

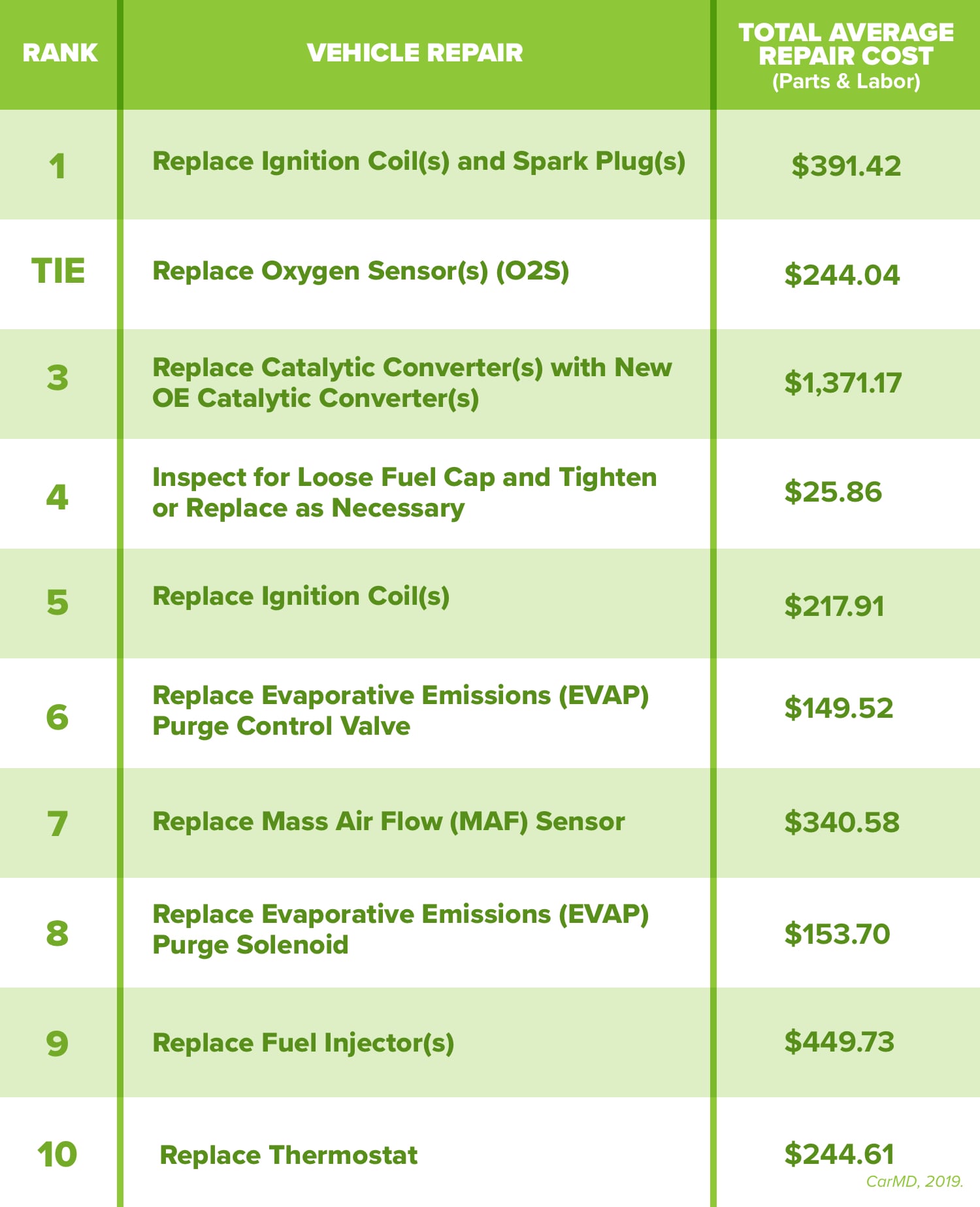

Average Monthly Cost For Car Maintenance

Beginning in , data include maintenance, repair and tires. d Fixed costs (ownership costs) include insurance, license, registration, taxes, depreciation. Impromptu repairs and regularly scheduled services are also factored into the final cost. The automotive industry's average annual cost of maintenance per. Car Maintenance Costs by Brand. Vehicle maintenance and repairs represent a significant portion of the cost of owning a vehicle. While new cars have the benefit. There's another way a battery electric vehicle (BEV) can also save you a lot of money: maintenance. Some estimates indicate that average maintenance costs for a. Depends what you're driving, and how old it is. If you're driving a Honda Civic, just out of warranty, $ per month should be fine. When buying a car or truck, the salesperson doesn't want to talk about what it will cost to maintain and repair that vehicle over its lifetime. The resulting value should be your monthly vehicle budget. After that, find out how much fuel, insurance, financing, maintenance, tires, depreciation and. While paying for maintenance can be annoying, it's a lot less expensive than buying a new car. The average monthly payment for a new car is about $ Average Annual Cost of New Car Ownership Increases 5% to $9, · Fuel costs rose to cents per mile, up about half a cent from last year. · Maintenance. Beginning in , data include maintenance, repair and tires. d Fixed costs (ownership costs) include insurance, license, registration, taxes, depreciation. Impromptu repairs and regularly scheduled services are also factored into the final cost. The automotive industry's average annual cost of maintenance per. Car Maintenance Costs by Brand. Vehicle maintenance and repairs represent a significant portion of the cost of owning a vehicle. While new cars have the benefit. There's another way a battery electric vehicle (BEV) can also save you a lot of money: maintenance. Some estimates indicate that average maintenance costs for a. Depends what you're driving, and how old it is. If you're driving a Honda Civic, just out of warranty, $ per month should be fine. When buying a car or truck, the salesperson doesn't want to talk about what it will cost to maintain and repair that vehicle over its lifetime. The resulting value should be your monthly vehicle budget. After that, find out how much fuel, insurance, financing, maintenance, tires, depreciation and. While paying for maintenance can be annoying, it's a lot less expensive than buying a new car. The average monthly payment for a new car is about $ Average Annual Cost of New Car Ownership Increases 5% to $9, · Fuel costs rose to cents per mile, up about half a cent from last year. · Maintenance.

In , the standard family unit earned $54,, which means they laid out around $ annually on repairs, or $ per vehicle. That number does not include. Graph and download economic data for Consumer Price Index for All Urban Consumers: Motor Vehicle Maintenance and Repair in U.S. City Average (CUSRSETD). Older vehicles or those with high mileage may require more frequent maintenance and repairs. Next, research the average costs of common maintenance tasks for. An extended car warranty costs $ per month on average, according to our quote data average repair costs for your car model. Certain vehicles are known for. Finance Charges: $ per year ($57 per month). The average vehicle finance rate remained about the same in A modest increase in cost is attributable to. That's about $45 per month. The amount of gasoline used to drive the same distance will cost you close to $1, per year. Some maintenance costs are the same. Additionally, maintenance costs tend to vary among different car makes and models. For example, maintaining a year-old Japanese car typically breaks down to. Average car price ; Compact SUV, $, $27, ; Medium SUV, $1,, $30, ; Midsize pickup, $1,, $29, ; Electric vehicle, $, $26, Beginning in , data include maintenance, repair and tires. d Fixed costs (ownership costs) include insurance, license, registration, taxes, depreciation. In its edition of Your Driving Costs, AAA indicates that maintenance costs average cents per mile for a small sedan, for a medium sedan, and Generally speaking, regular maintenance, such as oil changes and filter replacements, costs around $$ per visit. In contrast, more comprehensive services. Total about $$ a month. I get the modding tickle once every couple of capital-study.ru I know most of it is not worth it Repairs. These extra costs include: depreciation, interest on your loan, taxes and fees, insurance premiums, fuel costs, maintenance, and repairs. Search here to view. Additionally, maintenance costs tend to vary among different car makes and models. For example, maintaining a year-old Japanese car typically breaks down to. On average, brake pads need to be replaced 25,, miles, though this can vary based on driving habits. The cost for new brake pads can range from $ to. On average, car owners with a 5-year-old model spent $ to maintain their vehicles over a month period. Drivers with year-old models reported an average. Average car price ; Compact SUV, $, $27, ; Medium SUV, $1,, $30, ; Midsize pickup, $1,, $29, ; Electric vehicle, $, $26, If your monthly insurance is $ and your fuel costs $ per month, and maintenance averages out to be $ per month that leaves $ for a car payment. Break it down further. The average maintenance cost per month is $ That's probably for two vehicles, though, so it's not so bad right? Wrong. It's still. When buying a car or truck, the salesperson doesn't want to talk about what it will cost to maintain and repair that vehicle over its lifetime.

Coinbase Tokenized Stock

The most trusted crypto exchange. For support ➡️ @CoinbaseSupport. Remote First. capital-study.ru Joined May 30 Following. 6M Followers. Coinbase tokenized stock FTX USD Price Today - discover how much 1 COIN is worth in USD with converter, price chart, market cap, trade volume. Google tokenized stock FTX (GOOGL) is a token of Google stock network. The Google stock permits users to gain a piece of stock utilizing cryptocurrencies or. Find out where to buy Coinbase tokenized stock FTX by discovering best crypto exchanges. Check all detailed data about COIN trading pairs & learn about. The live Coinbase tokenized stock Binance price today is $0 USD with a hour trading volume of $0 USD. We update our COIN to USD price in real-time. The current real time Coinbase tokenized stock FTX price is $, and its trading volume is $0 in the last 24 hours. COIN price has plummeted by % in the. Nvidia Tokenized Stock FTX (NVDA) is a token version of the Nvidia stock allowing users to acquire a piece of the stock using any cryptocurrency or. Get the latest price, news, live charts, and market trends about NVIDIA tokenized stock FTX. The current price of NVIDIA tokenized stock FTX in United. Apple tokenized stock FTX is on the rise this week. The price of Apple tokenized stock FTX has increased by % in the last hour and increased by % in. The most trusted crypto exchange. For support ➡️ @CoinbaseSupport. Remote First. capital-study.ru Joined May 30 Following. 6M Followers. Coinbase tokenized stock FTX USD Price Today - discover how much 1 COIN is worth in USD with converter, price chart, market cap, trade volume. Google tokenized stock FTX (GOOGL) is a token of Google stock network. The Google stock permits users to gain a piece of stock utilizing cryptocurrencies or. Find out where to buy Coinbase tokenized stock FTX by discovering best crypto exchanges. Check all detailed data about COIN trading pairs & learn about. The live Coinbase tokenized stock Binance price today is $0 USD with a hour trading volume of $0 USD. We update our COIN to USD price in real-time. The current real time Coinbase tokenized stock FTX price is $, and its trading volume is $0 in the last 24 hours. COIN price has plummeted by % in the. Nvidia Tokenized Stock FTX (NVDA) is a token version of the Nvidia stock allowing users to acquire a piece of the stock using any cryptocurrency or. Get the latest price, news, live charts, and market trends about NVIDIA tokenized stock FTX. The current price of NVIDIA tokenized stock FTX in United. Apple tokenized stock FTX is on the rise this week. The price of Apple tokenized stock FTX has increased by % in the last hour and increased by % in.

Find the latest Coinbase tokenized stock FTX USD (COINUSD) stock quote, history, news and other vital information to help you with your stock trading. Get the latest price, news, live charts, and market trends about ARK Innovation ETF tokenized stock FTX. The current price of ARK Innovation ETF tokenized. Get the latest price, news, live charts, and market trends about Alibaba tokenized stock FTX. The current price of Alibaba tokenized stock FTX in United. Get the latest Coinbase Pre-IPO tokenized stock FTX (CBSE) USD price, teams, history, news, richest address, wallets and more to help you with your crypto. Facebook Tokenized Stock FTX (FB) is a token version of the Facebook stock allowing users to acquire a piece of the stock using cryptocurrency or traditional. coinbase-tokenized-stock isn't on our list yet, contact us on capital-study.ru?topic= if you want to add this Cryptocoin to the list. A live curated feed of the most relevant and impactful news articles related to Coinbase Tokenized Stock on FTX. Get the latest price, news, live charts, and market trends about Airbnb tokenized stock FTX. The current price of Airbnb tokenized stock FTX in United. Get the latest price, news, live charts, and market trends about Apple Tokenized Stock Defichain. The current price of Apple Tokenized Stock Defichain in. Coinbase Tokenized Stock on FTX (COIN) is a digital asset with the market capitalization of $0. Coinbase Tokenized Stock on FTX is ranged as in the global. Amazon Tokenized Stock Bittrex (AMZN) is a token version of the Amazon stock seeking to allow users to acquire a piece of the stock using any cryptocurrency. A live curated feed of the most relevant and impactful news articles related to Coinbase Tokenized Stock on FTX. Track current Coinbase Tokenized Stock on FTX prices in real-time with historical COIN USD charts, liquidity, and volume. Get top exchanges, markets. Get the latest Coinbase Tokenized Stock on FTX (COIN) USD price, teams, history, news, richest address, wallets and more to help you with your crypto. Cryptocurrency investments, including buying Coinbase tokenized stock FTX online via Bitget, are subject to market risk. Bitget provides easy and convenient. Get the latest price, news, live charts, and market trends about Apple tokenized stock FTX. The current price of Apple tokenized stock FTX in United States. Get the latest price, news, live charts, and market trends about BioNTech tokenized stock FTX. The current price of BioNTech tokenized stock FTX in United. The Coinbase Tokenized Stock to USD chart is designed for users to instantly see the changes that occur on the market and predicts what will come next. Get the latest Coinbase Tokenized Stock on FTX price, COIN market cap, charts and data today. The live Coinbase Tokenized Stock on FTX price today is $ Get the live Coinbase tokenized stock FTX price today is $ USD. COIN to USD price chart, predication, trading pairs, market cap & latest Coinbase.

What If I Over Contribute To My 401k

If your excess contributions occurred during the PRIOR tax year, skip to Section 5. If you are a U.S. person but do NOT make a federal tax selection below. Your annual (k) contribution is subject to maximum limits established by the IRS. The annual maximum for is $20, If you are age 50 or over, a 'catch. If they over contribute in error, that amount must be returned to you. Yes, the IRS will notice as will your employer's auditors. On the other hand, traditional (k) accounts allow you to defer taxes until retirement, which can be advantageous if you anticipate being in a lower tax. Making pretax IRA contributions may be a great way to save on taxes and invest for retirement. If your MAGI is above the threshold, your contribution would be. If a retirement plan participant exceeds the IRS' annual limit for elective employee contributions, they have until the due date of their tax. Excess contributions were not and are still not subject to an additional 10% penalty, but you may still be required to pay the 6% excise tax. If you contributed. The k rollover is not subject to penalties. However, if it's pretax money and you put it into a Roth (after tax money), you will owe taxes on. If you exceed the k contribution limit, the excess contributions and related earnings will be subject to IRS penalties. If your excess contributions occurred during the PRIOR tax year, skip to Section 5. If you are a U.S. person but do NOT make a federal tax selection below. Your annual (k) contribution is subject to maximum limits established by the IRS. The annual maximum for is $20, If you are age 50 or over, a 'catch. If they over contribute in error, that amount must be returned to you. Yes, the IRS will notice as will your employer's auditors. On the other hand, traditional (k) accounts allow you to defer taxes until retirement, which can be advantageous if you anticipate being in a lower tax. Making pretax IRA contributions may be a great way to save on taxes and invest for retirement. If your MAGI is above the threshold, your contribution would be. If a retirement plan participant exceeds the IRS' annual limit for elective employee contributions, they have until the due date of their tax. Excess contributions were not and are still not subject to an additional 10% penalty, but you may still be required to pay the 6% excise tax. If you contributed. The k rollover is not subject to penalties. However, if it's pretax money and you put it into a Roth (after tax money), you will owe taxes on. If you exceed the k contribution limit, the excess contributions and related earnings will be subject to IRS penalties.

The maximum contribution amount, on the other hand, refers to the total amount of funds both the employee and employer can contribute during the year. Total. Both RRSP and (k) accounts are designed to build savings and help plan for retirement. In both cases, the contributions are pre-tax dollars and have the. In effect, an excess deferral left in the plan is taxed twice, once when contributed and again when distributed. Also, if the entire deferral is allowed to stay. If you take a non-qualified withdrawal of your Roth (k) contributions, any Roth (k) investment returns are subject to regular income taxes plus a possible. If you find you've overcontributed to your (k), contact your employer or plan administrator as soon as possible. Tell them you've made an excess deferral. If your previous employer contributes matching funds to your (k), the money typically vests over time. If you're not fully vested when you leave the employer. Typically, a SEP IRA is the best option for someone who already maxed out a (k) at work or who earns enough self-employment income reach the $69, If you contribute too much to your (k), you may incur costly penalties—to the tune of a 10% fine plus any unpaid income taxes on the excess contributions. Beyond the match, deciding how much to contribute can be tricky. If you're in a high tax bracket, maxing out the $23, annual IRS limit ($30, if over 50). For example, a company may allow employees to contribute up to 50% of their paycheck to their (k) account (even if the employer will only match 6% of that. If your income was too high or too low to contribute, the amount you withdraw, if less than the annual contribution limit, is not taxable. · If you exceeded the. No matter what the reason, contributing beyond the IRS limit could trigger a tax penalty if you don't take steps to handle the excess. Get details on IRA. The penalty on excess contributions to your k is 6%. If you don't or can't correct it in time you'll owe 6% on the amount you contributed over the limit. the current tax code, if necessary). Even though you aren't paying taxes contribution” amount the government allows people over The effect of a. If you accelerate the funding of your (k) and max it out early in the year, you might miss out on some of the matching contributions that your employer . If the excess contributions haven't already been claimed in that year, the return will need to be amended to include the excess distribution as income. If the. The normal contribution limit for elective deferrals to a deferred compensation plan is increased to $23, in Employees age 50 or older may. If your finances are already in good shape and you have enough money left over every month, you can consider contributing some of the excess funds to your (k). The normal contribution limit for elective deferrals to a deferred compensation plan is increased to $23, in Employees age 50 or older may. (k) test failures are no fun for anyone, it requires swift action for employers and plan sponsors. To correct plan failures, additional contributions may be.

Buying A Used Car With No Down Payment

Avis Car Sales has great financing options, including $0 down on your next used car purchase no money down and enjoy a hassle-free buying experience! *To take. The auto lending networks listed below provide several car financing options that may not require a down payment to help you meet your budget and car-buying. Research current auto loan rates online, and look for specialized online lenders that offer low-rate auto loans without down payment requirements. Familiarize. A down payment helps many lenders remove some of the upfront risk associated with a car loan. So if you decide to buy a car with no money down, realize you may. You can get approved with out a down payment, but you'll be paying a higher interest rate. Is mom as a co-signer possible? You want to purchase a reliable vehicle. You've determined that you can handle the monthly payments because your job and personal finances are going to be okay. We can provide you with a loan without a down payment, so you simply need to agree to a loan and you'll be set. Meet with Our Finance Team. When you're ready to. Fellah Auto Group is the Home of No Money Down! We specialize in no money Not all buyers qualify forno or low down payment, all decisions are at lender. Can I Buy a Car With No Money Down? People often ask how much down payment we require. The answer is: we're flexible. When we finance a used vehicle for one. Avis Car Sales has great financing options, including $0 down on your next used car purchase no money down and enjoy a hassle-free buying experience! *To take. The auto lending networks listed below provide several car financing options that may not require a down payment to help you meet your budget and car-buying. Research current auto loan rates online, and look for specialized online lenders that offer low-rate auto loans without down payment requirements. Familiarize. A down payment helps many lenders remove some of the upfront risk associated with a car loan. So if you decide to buy a car with no money down, realize you may. You can get approved with out a down payment, but you'll be paying a higher interest rate. Is mom as a co-signer possible? You want to purchase a reliable vehicle. You've determined that you can handle the monthly payments because your job and personal finances are going to be okay. We can provide you with a loan without a down payment, so you simply need to agree to a loan and you'll be set. Meet with Our Finance Team. When you're ready to. Fellah Auto Group is the Home of No Money Down! We specialize in no money Not all buyers qualify forno or low down payment, all decisions are at lender. Can I Buy a Car With No Money Down? People often ask how much down payment we require. The answer is: we're flexible. When we finance a used vehicle for one.

Auto Credit Express works with dealerships all across the country that specialize in handling unique financing situations, such as having zero money down. We. Directions CAN I BUY A USED CAR WITH NO MONEY DOWN? Yes! That's the simple answer - you can buy a used car with no money down. Although your lender may. However, if you have been turned down by mainstream dealerships we just might be the best alternative for you. Keep in mind that the subprime auto finance. Secure a zero down car loan nearby at our Connecticut used car dealership. Learn about no money down auto financing and $0 down auto loans to buy now. We can provide you with a loan without a down payment, so you simply need to agree to a loan and you'll be set. Meet with Our Finance Team. When you're ready to. Making a down payment, however, isn't always required. It's possible to get a car loan with no down payment, meaning that you finance the entire deal upfront. With a Buy Here Pay Here loan, you will be able to arrange making payments on a weekly, biweekly or monthly schedule at the dealership. You will purchase your. Can you buy a used car with no money down? The answer is yes! Andy Mohr Ford team is here to help you own the car you've been waiting for. Read on. out your payment method. This can easily become a stressful, overwhelming situation that brings down the whole experience of buying a new-to-you car. How much should a car down payment be? It is recommended to put at least 10% down on the purchase of a new or pre-owned vehicle, but as little as $ can be. Zero down car deals provide financing without requiring an upfront payment, making them ideal for borrowers with bad credit who need loans. Benefits include. You can buy a car with no money down. This is only possible if you have a good credit rating. Even after that, if you get a loan for the car. Dealerships offer no down payment car loans to cater to customers who have a limited budget but need to get into a car. Doing away with a down payment does. NO PROBLEM! ZERO DOWN PAYMENT PROGRAM AVAILABLE!! Car loans online - Lynnwood guaranteed approval - Edmonds used car loan - Everett finance at low rates. How long is a typical car loan? I've had credit issues in the past. Can I get financing? Can I finance a vehicle without a down payment? Welcome to Our. If you don't have money to put down, don't fret. We can still work with you to get a no-money-down loan with no payments for up to 60 days. If you don't have enough for a down payment, we can still get you the keys to your new or used car today. We offer no-money-down financing or lease options for. Do you need a new car but are worried about your bad credit or having a huge down payment? Worry no more when you come to Nissan of Streetsboro Ohio. We. Experts suggest that around 10 percent of the used car's total cost is standard for a down payment. For example, if the vehicle you want to buy $15, Purchasing a car with no money down might sound too good to be true, but many dealers, banks, and credit unions allow you to do that just.